Irs Definition Of Off The Shelf Software

Image source: By MdeVicente [CC0], via Wikimedia Commons (Public domain) Unlike computer software, the US tax code has no built-in error messages. That can lead to user confusion, such as when you’re trying to figure out how to deduct the cost of software. For example, the software you purchase to complete your individual income tax return is considered a tax preparation fee. When you itemize, you can include the cost on Schedule A and deduct it, subject to a 2% haircut. For businesses, the tax treatment of software is murkier.

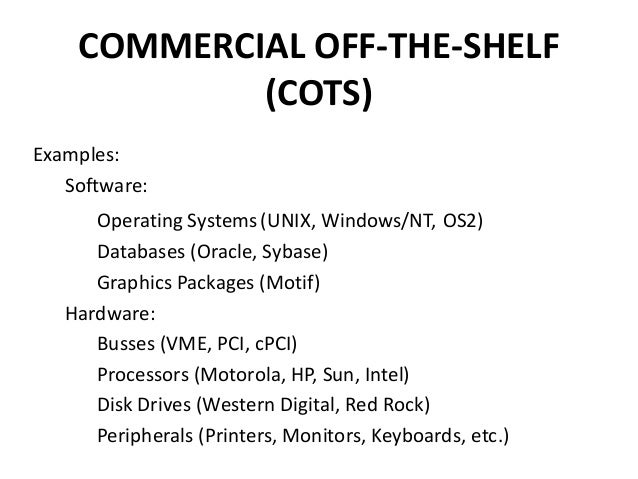

Nov 18, 2016. Maximize your purchasing power by capitalizing on the IRS tax code section 179 incentive for business investment. Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during. Off-the-shelf computer software. Define off-the-shelf. Off-the-shelf synonyms, off-the-shelf pronunciation, off-the-shelf translation, English dictionary definition of off-the-shelf.

Mora Piya Mose Bole Na Fuzon Mp3 Download. Off-the-shelf software—the business-use equivalent of your tax program—can be fully deductible under code section 179 or depreciable over a three year term. To qualify for immediate expensing, the software must be readily available for purchase, subject to a nonexclusive license, and used as-is. (Note that eligibility for section 179 is part of the annual “extender” tax rules and has expired for 2015, but may be retroactively reinstated before the end of the year.) Other software used by businesses is generally considered intangible property and the tax treatment depends on whether the software is purchased or leased.

Software that a company develops is treated in a manner similar to research costs, and may be expensed or capitalized and amortized. Costs related to software, such as the computer itself (hardware), as well as maintenance, trouble shooting, and training employees, may be depreciated or expensed currently. In, released in 2002 and still effective today, the IRS considered the question of the tax treatment for a specialized software known as Enterprise Resource Planning (ERP). This software integrates different modules for financial accounting, inventory control, production, sales and distribution, and human resources.

Descargar Manual Lavadora Blue Sky Blf 1009 Hamilton. Usually consultants are hired to implement the package by customizing the software programs and routines to fit specific needs. This implementation is accomplished by using templates and pre-set programs and by writing additional machine readable code. The software is not usable until the implementation is completed. The taxpayer bought computer hardware and ERP software and entered into a consulting agreement for additional software development and employee training. In addition, the taxpayer entered into an agreement for the consultant to act as project manager for the implementation and design modifications. The taxpayer entered into an agreement with a second company for additional training, software design enhancements, and technical issue resolution. The actual cost for the software and the consulting combined, excluding the computer hardware, was almost four times higher than budgeted.